Licensed In All 50 States

Step-by-Step Walkthrough for

Safe Retirement Planning

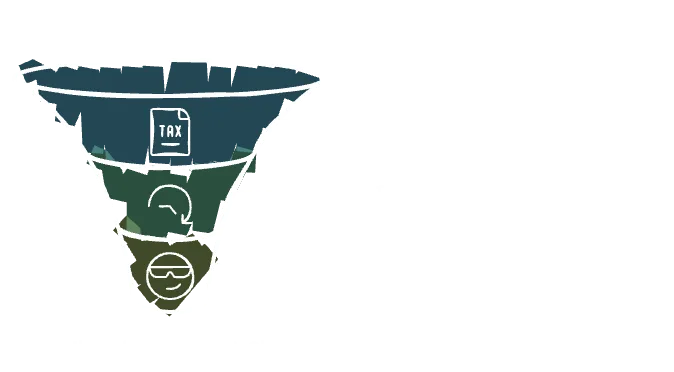

Step 1: Qualification

The first step in your retirement planning journey is qualification. During this phase, we will assess your current financial situation, retirement goals, and risk tolerance. This involves:

Gathering Personal Information: We will collect details about your income, expenses, assets, and liabilities.

Understanding Your Goals: Discuss your retirement dreams, such as desired retirement age, lifestyle, and any specific financial needs.

Risk Assessment: Evaluate your comfort level with investment risks to tailor a plan that suits you best.

- Post-Tax Dollars

- Pre-Tax Dollars

Post-Tax Dollars (Already Taxed)

- Healthy: Tax-free cash value growth and life insurance.

- Unhealthy: Annuities for secure, tax-deferred growth without market risk.

Tax Strategy:

Choose between Tax-Free or Tax-Deferred options based on your long-term goals.

Pre-Tax Dollars (e.g., Retirement Accounts)

Under 59 ½:

Opt for Tax-Deferred products (like annuities) to avoid penalties.

Over 59 ½ (Health Check):

- Healthy: Tax-free cash value growth and life insurance.

- Unhealthy: Annuities for tax-deferred or tax-free income.

Step 2: Design

Once we have qualified your needs and goals, we will move on to the design phase. Here, we will create a customized retirement plan that aligns with your objectives. This includes:

Choosing the Right Products: Selecting financial products that offer safety and growth without market exposure.

Creating a Strategy: Developing a comprehensive strategy that outlines how your retirement funds will be allocated.

Visualizing Your Plan: Providing you with a clear visual representation of your retirement plan, including projected growth and income streams.

- Cash Value Life Insurance

- Annuities

- Guaranteed Lifetime Income Rider

Cash value life insurance allows you to accumulate savings while maintaining life insurance protection. It includes:

- Universal Life (UL): Options include Indexed Universal Life (IUL), Guaranteed Universal Life (GUL), and Survivorship Universal Life (SUL).

- Whole Life Insurance: Offers guaranteed premiums and cash value growth.

Annuities offer a guaranteed income stream for life or a specified period. Options include:

- Fixed Annuities: Offers a guaranteed rate of return.

- Fixed Indexed Annuities: Provides growth linked to a stock market index while protecting against losses.

Immediate vs. Deferred Annuities

Immediate annuities start payments almost immediately, while deferred annuities accumulate savings over time before payments begin.

What is a Guaranteed Lifetime Income Rider (GLIR)?

A Guaranteed Lifetime Income Rider is an additional feature in annuities and some cash value life insurance policies that ensures a steady income throughout retirement.

Even if your accumulation value depletes, the rider guarantees income for life, with access to remaining funds if needed. Withdrawals reduce the accumulation over time.

If the annuitant dies with a remaining balance, that money will be passed on to beneficiaries.

*Rider options and benefits vary based on the annuity contract.

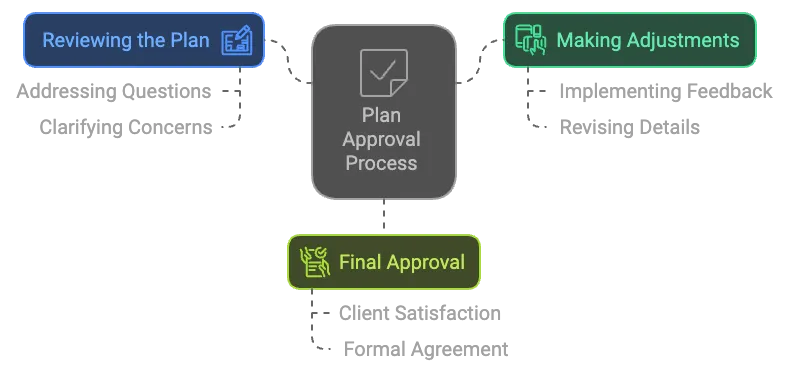

Step 3: Approvals

After the design phase, we will seek your approval on the proposed retirement plan. This step ensures that you are fully comfortable with the strategy before moving forward. Key actions include:

Reviewing the Plan: We will go through the details of the plan together, addressing any questions or concerns you may have.

Making Adjustments: If necessary, we can make adjustments to the plan based on your feedback.

Final Approval: Once you are satisfied, we will obtain your formal approval to proceed.

- Cash Value Life Insurance

- Annuity Approval

Cash Value Life Insurance Approval Options

- Instant Decision: Immediate approval based on application data.

- Non-Medical (3-14 Days): Approval typically within 3 to 14 days without a medical exam.

- Medical (5-45 Days): Requires a medical exam, with approval taking between 5 to 45 days.

Annuity Approval

Annuity applications are typically approved within 5-14 days, depending on carrier requirements and complexity. This timeline applies to both fixed and fixed indexed annuities.

Step 4: Funding

With your plan approved, we will move to the funding phase. This step involves:

Setting Up Accounts: Establishing the necessary accounts to implement your retirement plan.

Transferring Funds: Coordinating the transfer of funds from existing accounts or investments into your new retirement plan.

Ensuring Compliance: Making sure all funding processes comply with regulatory requirements.

- Annuity Transfer Methods

- Cash Value Life Insurance Funding

Annuity Transfer Methods

- Indirect Transfer: A check is issued to the client, who then forwards it to the annuity company.

- Direct Transfer: Funds are transferred directly from the original company to the annuity provider for a quicker, seamless process.

Cash Value Life Insurance Funding

- Annual Payments: Funding can be done via wire transfer or mailed checks.

- Monthly Payments: Payments are automatically deducted via Electronic Funds Transfer (EFT) from your bank account, processed 72 hours after policy approval.

Step 5: Accumulation Phase

During the accumulation phase, your retirement funds will grow according to the strategy we designed. This phase includes:

Monitoring Growth: Regularly reviewing the performance of your investments to ensure they are on track.

Adjusting Contributions: Making any necessary adjustments to your contributions based on your financial situation and goals.

Staying Informed: Keeping you updated on any changes in the market or regulations that may affect your plan.

- Online Portal

- Semi-Annual Meetings

- Quarterly Market Analysis

Online Portal

Stay connected with your retirement strategy through our secure online portal, giving you 24/7 access to real-time updates and performance metrics.

Semi-Annual Meetings

Meet with us twice a year to review your progress, discuss adjustments, and ensure your strategy continues to align with your retirement goals.

Quarterly Market Analysis

Receive a quarterly market analysis, focusing on the S&P 500, to help guide informed decisions and adjust your portfolio as needed.

Step 6: Distribution Phase

Finally, we will enter the distribution phase, where you begin to access your retirement funds. This phase involves:

Creating a Distribution Strategy: Developing a plan for how and when you will withdraw funds from your retirement accounts.

Tax Considerations: Discussing the tax implications of your withdrawals to maximize your income.

Ongoing Support: Providing continuous support and adjustments to your distribution strategy as needed throughout your retirement.

- Cash Value Life Insurance

- Annuities

Cash Value Life Insurance (Tax-Free Withdrawals)

Access the cash value of your life insurance policy through tax-free loans or withdrawals. This provides flexibility in retirement while preserving the death benefit for your beneficiaries.

Annuities (Tax-Deferred)

Annuities offer tax-deferred growth for your retirement income, with two main options:

- Roth IRA Annuities: Withdraw your funds tax-free after meeting Roth IRA conditions, ensuring you maximize your income in retirement without tax implications.

- Traditional Annuities: Benefit from tax-deferred growth and pay taxes only when you withdraw your earnings, allowing your funds to grow without immediate tax liability.

Customer Service

Contact Us

2024 Lone Wolf Insurance. All Rights Reserved